The future of payroll is no longer a distant vision — it’s unfolding right now. From increased government scrutiny to rising employee expectations, payroll has become a strategic function rather than just a back-office process. According to Deloitte, nearly 60% of businesses are actively modernizing payroll to improve accuracy, compliance, and employee satisfaction.

If you’re still using spreadsheets or disconnected systems, you’re likely wasting time, exposing your business to compliance risks, and frustrating your team. But there’s good news — with the right tools and automation in place, payroll can become one of your most reliable, efficient, and employee-friendly workflows.

In this blog, we’ll explore:

- Why the future of payroll is central to business growth

- The biggest changes shaping payroll across industries

- Practical steps to improve your payroll process today

- How automation and a CRM + ERP platform like CRMLeaf can help

Why Payroll Modernization Matters for Your Business

Payroll isn’t just about cutting checks. It’s a direct reflection of how your business values accuracy, compliance, and employee well-being. Here’s why modernizing payroll is non-negotiable in today’s business environment:

- High Stakes Compliance: Labor laws, tax codes, and statutory deductions change frequently. Missing a deadline or misclassifying an employee can lead to audits, penalties, or lawsuits. Automated payroll systems help you stay compliant, error-free, and audit-ready.

- Employee Trust and Satisfaction: When employees are paid late or inaccurately, trust erodes. A well-run, transparent payroll process reinforces a culture of reliability and professionalism. This is critical for retention, especially in high-turnover industries like retail, construction, and logistics.

- Operational Efficiency: Manual payroll is time-consuming and error-prone. Integrating payroll with your HR and finance systems eliminates duplicate work and frees up your team to focus on strategy.

- Scalability for Growth: As your business grows, payroll becomes more complex. New tax jurisdictions, contract types, and benefit structures emerge. The future of payroll lies in scalable solutions that grow with you.

What’s Driving the Future of Payroll?

Several factors are transforming how businesses handle payroll:

1. Payroll Automation is Now Essential

- Eliminates repetitive tasks: Automation reduces the need for manual data entry, making pay cycles faster and more reliable.

- Improves real-time accuracy: Errors are flagged instantly, ensuring accurate deductions, reimbursements, and benefits.

- Reduces cost and labor: Businesses save money on admin hours and reduce payroll staff burden.

2. Compliance is Getting More Complex — and Critical

- New labor laws and tax codes are being introduced across regions.

- Freelancers, gig workers, and remote teams add complexity.

- Automated systems ensure that every update — from tax slabs to EPF/ESI — is handled in real time.

3. Employee Experience is Tied to Payroll

- Transparent, on-time payments build trust.

- Features like self-service payslip access, real-time leave tracking, and reimbursement visibility empower employees.

- A positive payroll experience enhances engagement, especially for remote and hybrid teams.

4. Integrated Platforms Are Replacing Disconnected Tools

- Businesses using separate apps for HR, accounting, and payroll are prone to sync errors.

- CRM + ERP platforms like CRMLeaf centralize data, reduce friction, and enable smarter decision-making.

Practical Tips: How to Prepare for the Future of Payroll

Ready to upgrade your payroll game? Here’s how to stay ahead:

Digitize and Centralize Your Payroll Data

- Replace spreadsheets and paper forms with a centralized digital platform.

- Choose a solution that integrates with HR, finance, and compliance tools.

Automate Key Processes

- Automate payslip generation, tax calculations, benefit deductions, and statutory compliance.

- Set recurring payroll schedules and alerts to eliminate delays.

Prioritize Compliance from Day One

- Select software that updates automatically with the latest regulations.

- Run periodic audits to detect errors before authorities do.

Empower Employees Through Self-Service Portals

- Give employees access to their payslips, tax declarations, and leave balances.

- Add mobile accessibility for hybrid or field-based teams.

Track Metrics and Use Payroll Analytics

- Monitor payroll KPIs like cycle time, error rate, and cost per payslip.

- Use insights to forecast costs and support budget planning.

Train Your HR & Finance Teams

- Regularly update your team on system changes and compliance requirements.

- Invest in user training during onboarding and after major updates.

Customer Success Snapshot

For example, GreenRoots Logistics, a fast-growing transportation company, used CRMLeaf’s payroll automation tools to reduce salary processing time by 75%. They integrated timesheets, leave approvals, and compliance tracking into a single workflow — all managed from one platform. This helped them ensure 100% on-time payments and a 30% drop in payroll-related queries.

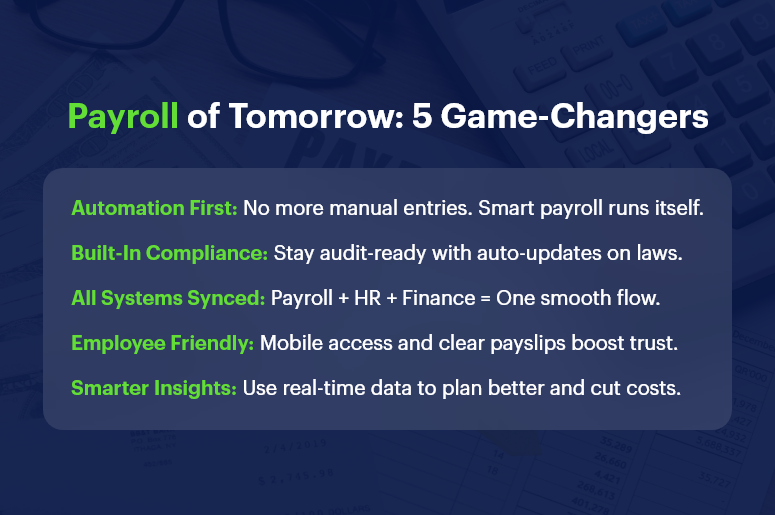

Key Takeaways: Shaping the Future of Payroll

The future of payroll demands automation, real-time compliance, and a better employee experience. Businesses that continue using outdated methods will fall behind — not just in efficiency but in trust and growth.

In summary:

- Automation isn’t optional anymore — it’s the baseline for payroll success.

- Compliance risks are growing — using automated systems ensures peace of mind.

- Employee satisfaction is directly tied to their payroll experience.

- CRM + ERP platforms like CRMLeaf offer an all-in-one solution for modern payroll challenges.

Investing in the right payroll system today will future-proof your business tomorrow.