Every startup in India reaches a point where payroll feels unavoidable — and expensive. Salaries must go out on time. Compliance must be maintained. Records must be clean. Yet, at the early stage, spending on payroll software or consultants often feels unjustifiable. The reality is simpler than most founders believe. With the right approach, Indian startups can manage payroll without spending a rupee — without risking compliance, accuracy, or team trust.

This guide walks you through exactly how to do that, step by step, while keeping things practical and sustainable.

Why Payroll Feels Expensive (Even When It Doesn’t Have to Be)

Payroll becomes expensive not because of statutory requirements, but because of fragmentation. Startups juggle spreadsheets, compliance portals, consultants, and reminders — each adding friction and hidden costs. Over time, founders end up paying for “convenience” rather than necessity.

However, once you centralize payroll logic and remove manual dependencies, it becomes entirely possible to manage payroll without spending a rupee, even as your team grows.

What It Really Means to Manage Payroll Without Spending a Rupee

Managing payroll for free does not mean cutting corners or ignoring compliance. Instead, it means removing unnecessary intermediaries while keeping statutory accuracy intact.

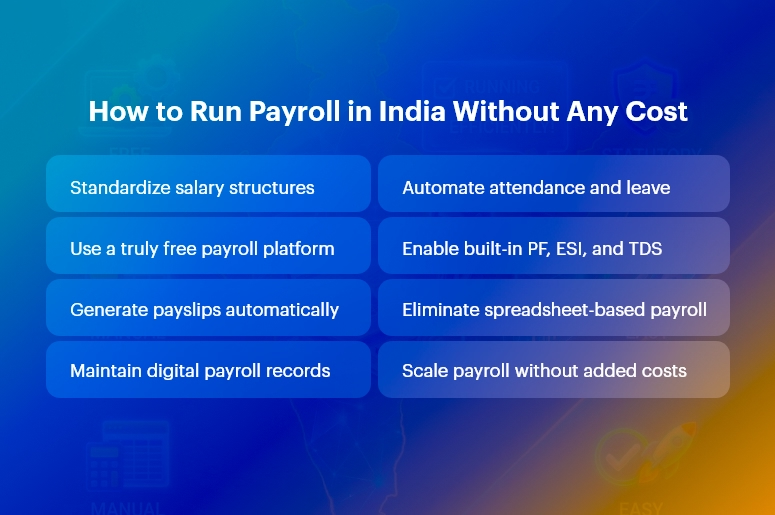

At a high level, when startups manage payroll without spending a rupee, they rely on:

- Pre-built payroll logic instead of manual calculations

- Built-in compliance handling rather than external consultants

- One system instead of multiple disconnected tools

This shift alone eliminates most payroll-related expenses.

Understanding Payroll in the Indian Startup Context

Before implementing any system, founders must understand what payroll actually includes. Payroll is not just salary payment — it is a structured financial and compliance process.

At its core, Indian payroll consists of:

- Salary structure (basic, allowances, deductions)

- Statutory compliance (PF, ESI, PT, TDS)

- Documentation (payslips, registers, reports)

Once these components are clearly defined, it becomes much easier to manage payroll without spending a rupee.

Why Manual Payroll Works — But Only Temporarily

Many startups begin with spreadsheets. Initially, this approach feels cost-effective and flexible. Founders manually calculate salaries, track attendance, and upload compliance data on government portals.

However, as months pass, cracks appear:

- Formula errors creep in

- Compliance dates get missed

- Founders become bottlenecks

- Scaling becomes painful

At this stage, startups realize that “manual” is free in money, but expensive in time. To truly manage payroll without spending a rupee, automation becomes essential.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.

The Shift from Manual to Smart-Free Payroll

The smartest startups do not jump from spreadsheets to paid tools. Instead, they move to free payroll platforms designed specifically for Indian compliance.

These platforms combine automation, compliance logic, and reporting — without charging subscription fees. As a result, startups retain control while eliminating repetitive work.

This is the turning point where startups successfully manage payroll without spending a rupee, month after month.

What a Truly Free Payroll System Must Offer

Not all “free” tools are actually free. Some restrict features, others limit employee count, and many introduce paid upgrades later. To genuinely manage payroll without spending a rupee, a system must include the following at no cost:

- Automated salary calculations based on Indian pay structures

- Built-in PF, ESI, and tax deduction logic

- Instant payslip generation

- Compliance-ready reports for audits and filings

- No employee limits or hidden charges

Without these, founders eventually end up paying — either in money or effort.

How Payroll Compliance Becomes Easier — Not Harder

One common fear is that free payroll systems compromise compliance. In practice, the opposite is true.

When payroll logic is automated:

- Statutory deductions are calculated correctly every month

- Compliance reports are generated instantly

- Filing deadlines are easier to track

This allows startups to manage payroll without spending a rupee while staying audit-ready and penalty-free.

Paying Employees Without Paying Payroll Vendors

Salary disbursement does not require paid payroll services. Indian startups can easily pay employees using existing banking infrastructure.

Most teams rely on:

- Bank transfers (NEFT/IMPS)

- Bulk upload salary files

- Zero-cost business banking features

When combined with automated payroll calculation, this completes the cycle of how to manage payroll without spending a rupee.

Free Payroll, PF, ESI & TDS Software

Where INDPayroll Fits Naturally

Some platforms are built with monetization as the priority. Others are built with startups in mind.

INDPayroll belongs to the second category.

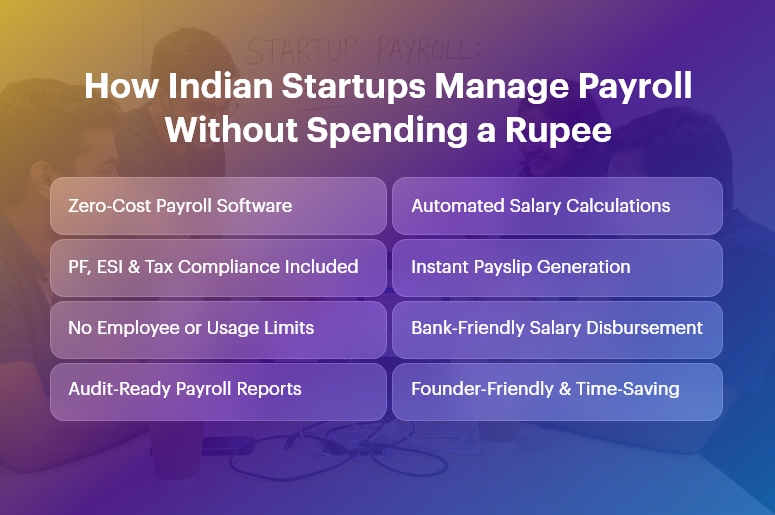

It allows Indian startups to:

- Run complete payroll cycles

- Handle PF, ESI, and tax deductions

- Generate payslips and reports

- Stay compliant

All without charging a single rupee.

This makes INDPayroll not a “free trial,” but a permanent free payroll solution — ideal for startups that want simplicity without compromise.

When Free Payroll Makes Strategic Sense

Free payroll is especially effective when:

- You are bootstrapped or early-stage

- Your team is small to mid-sized

- You want predictable, zero-cost operations

- You prefer clarity over complexity

In these scenarios, paying for payroll software offers little incremental value.

Final Thoughts

Indian startups no longer need to choose between accuracy and affordability. Today, it is entirely possible to manage payroll without spending a rupee — while remaining compliant, organized, and scalable.

By replacing fragmented manual processes with a unified, free payroll system, founders reclaim time, reduce risk, and preserve capital.

Payroll should not be a financial burden.

It should be invisible, reliable, and cost-free.

And now, it finally is.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.