In 2025, more than 70% of small and mid-sized businesses still struggle with payroll accuracy, compliance, and month-end delays, despite having access to modern technology. For many organizations, payroll remains a stressful, error-prone process driven by spreadsheets, manual calculations, and disconnected tools. A single mistake can lead to penalties, employee dissatisfaction, and lost trust.

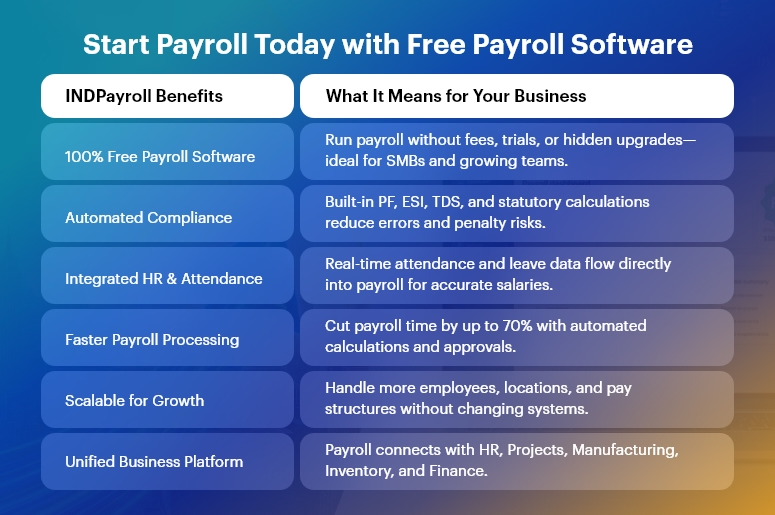

This is exactly why free payroll software has become a strategic necessity—not just a cost-saving option. Businesses today need systems that are accurate, compliant, automated, and scalable without adding financial burden.

Moreover, payroll no longer exists in isolation. It touches HR, finance, compliance, attendance, projects, manufacturing output, and even sales incentives. When these systems don’t talk to each other, operational inefficiencies multiply.

In this blog, you will learn why free payroll software matters in 2026, how to implement it the right way, and how INDPayroll helps businesses automate payroll end-to-end—without fees, trials, or hidden limits. Whether you manage operations, HR, finance, or delivery teams, this guide will help you make smarter payroll decisions.

Business Need & Importance

Payroll has evolved from a back-office function into a business-critical operational pillar. Today’s organizations operate in a complex environment shaped by frequent regulatory changes, distributed workforces, variable pay structures, and rising employee expectations.

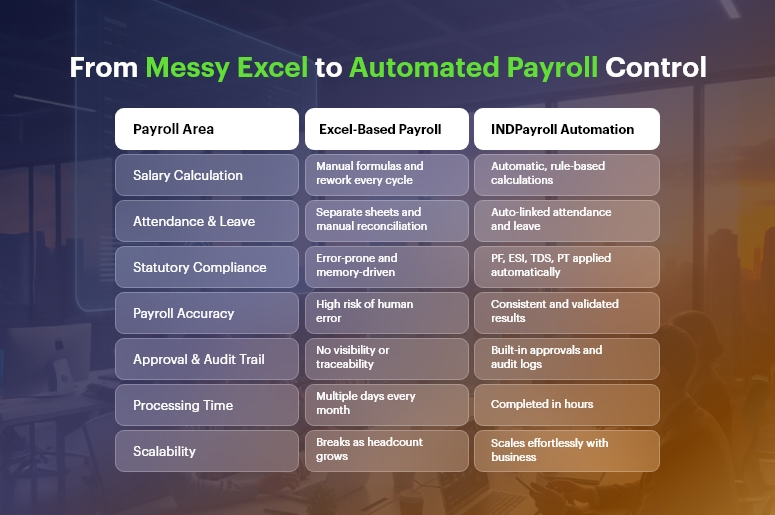

However, many growing businesses still rely on Excel sheets, email approvals, and manual calculations. As a result, they face compliance risks, delayed salaries, inaccurate deductions, and poor audit readiness. Over time, these issues directly impact productivity, retention, and brand credibility.

In manufacturing, payroll accuracy is tied to shifts, overtime, and production-linked incentives. Even small miscalculations can distort labor costs and profitability.

In retail and distribution, businesses manage variable attendance, seasonal hiring, and location-based compliance, which spreadsheets simply cannot scale.

In services and IT-enabled industries, payroll connects deeply with project hours, billable utilization, and statutory reporting.

Moreover, manual payroll processes consume valuable time. HR and finance teams spend days reconciling data instead of focusing on workforce planning and strategic analysis. This inefficiency becomes unsustainable as organizations grow beyond 20–30 employees.

Therefore, free payroll software is no longer about saving money alone. It is about reducing operational risk, improving compliance confidence, enabling scalability, and creating connected workflows across HR, finance, projects, and manufacturing operations. Businesses that modernize payroll early gain a measurable competitive advantage.

Free Payroll, PF, ESI & TDS Software

Best Practices, Frameworks & Actionable Tips

Step 1: Centralize Employee Data Across Functions

A foundational best practice is maintaining a single source of truth for employee data. Payroll errors often originate from inconsistent or outdated records across HR, attendance, and finance systems.

With INDPayroll, employee data flows seamlessly across HRMS, Payroll, Attendance, Projects, and Manufacturing modules, ensuring every salary calculation reflects real-time inputs.

Step 2: Automate Statutory Compliance by Default

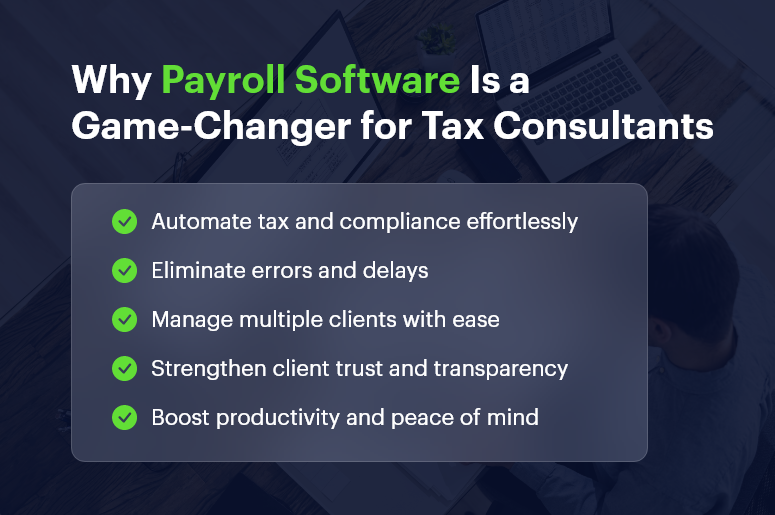

In 2025, compliance cannot be optional or manual. Businesses must automate PF, ESI, TDS, professional tax, and payslip generation.

Free payroll software from INDPayroll embeds compliance logic into the system, reducing dependency on manual checks while ensuring audit readiness.

Step 3: Integrate Payroll with Attendance and Overtime

Payroll accuracy depends on accurate time data. However, many organizations still reconcile attendance manually at month-end.

INDPayroll integrates daily attendance, shift hours, and overtime calculations directly into payroll, eliminating rework and reducing payroll processing time significantly.

Step 4: Align Payroll with Projects and Production

Payroll becomes more complex when linked to projects, contracts, or production output.

INDPayroll connects Projects, Manufacturing, and Payroll, enabling accurate wage allocation, incentive calculation, and cost tracking — without spreadsheets.

Step 5: Use Mini Checklists for Monthly Payroll Runs

Even automated systems need structured processes. A simple checklist ensures consistency:

- Validate attendance and leave data before payroll closure

- Review statutory deductions and exemptions

- Generate payslips and compliance reports

- Lock payroll data for audit integrity

INDPayroll supports these workflows with built-in approvals and reporting dashboards.

Common Mistakes to Avoid

- Relying on Excel for growing teams beyond 20 employees

- Managing payroll separately from HR and finance

- Ignoring real-time compliance updates

- Choosing tools with hidden costs after trials

Why INDPayroll Is a Superior End-to-End Solution

Unlike fragmented tools, INDPayroll unifies CRM, HRMS, Payroll, Projects, Manufacturing, Inventory, and Finance on one platform. This connected approach ensures payroll accuracy reflects actual business operations — not assumptions.

Additionally, INDPayroll’s free payroll software model removes cost barriers, allowing businesses to modernize without financial risk.

Customer Success Example

For example, Sharma Engineering Works, a mid-sized manufacturing business, implemented Payroll and Attendance Automation using INDPayroll to solve recurring salary errors and overtime disputes.

Previously, payroll processing took 4–5 days each month, with frequent corrections after salary disbursement.

Within 60 days, the company achieved 98% payroll accuracy, reduced payroll processing time by 70%, and eliminated manual reconciliation between attendance, production shifts, and finance records.

Overtime calculations became transparent, and compliance filings were generated automatically.

Here’s how it transformed their operations: HR teams gained confidence in payroll runs, finance teams accessed real-time labor cost reports, and employees received accurate, on-time salaries with detailed payslips.

Most importantly, leadership gained visibility into workforce costs linked directly to production output—enabling smarter operational decisions.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.

Key Takeaways & Closing

Payroll in 2025 demands more than calculations — it requires accuracy, compliance, speed, and integration. Businesses that continue relying on manual processes expose themselves to avoidable risks and inefficiencies.

By adopting free payroll software, organizations can modernize operations without increasing costs. INDPayroll enables this transformation by connecting payroll with HR, projects, manufacturing, inventory, and finance — creating a truly unified operational ecosystem.

As regulatory complexity increases and workforces become more dynamic, the need for reliable, automated payroll will only grow. Businesses that act now will not only reduce risk but also build scalable, future-ready operations.

With free payroll software from INDPayroll, payroll becomes a strategic advantage—not a monthly headache.

FAQs

1. What makes INDPayroll different from other free payroll software?

INDPayroll offers truly free payroll software with no usage limits, no trials, and no hidden upgrades, while integrating HR, finance, and operations in one system.

2. Is free payroll software reliable for compliance in India?

Yes. INDPayroll automates PF, ESI, TDS, and statutory reporting, making free payroll software both accurate and compliance-ready.

3. Can growing businesses scale using free payroll software?

Absolutely. INDPayroll is designed for scalability, supporting growing teams, multiple locations, and complex payroll structures.

4. Does free payroll software integrate with attendance and HR?

INDPayroll seamlessly integrates payroll with attendance, HRMS, projects, and manufacturing, ensuring real-time accuracy.

5. Is data secure in INDPayroll’s free payroll software?

Yes. INDPayroll follows enterprise-grade security practices, ensuring payroll and employee data remain protected.

6. How long does it take to implement INDPayroll?

Most businesses can configure and start payroll within days, thanks to intuitive workflows and guided setup.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.