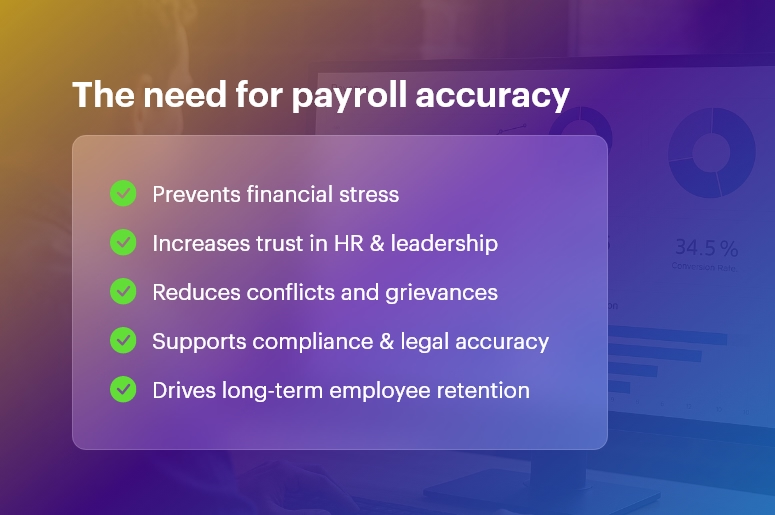

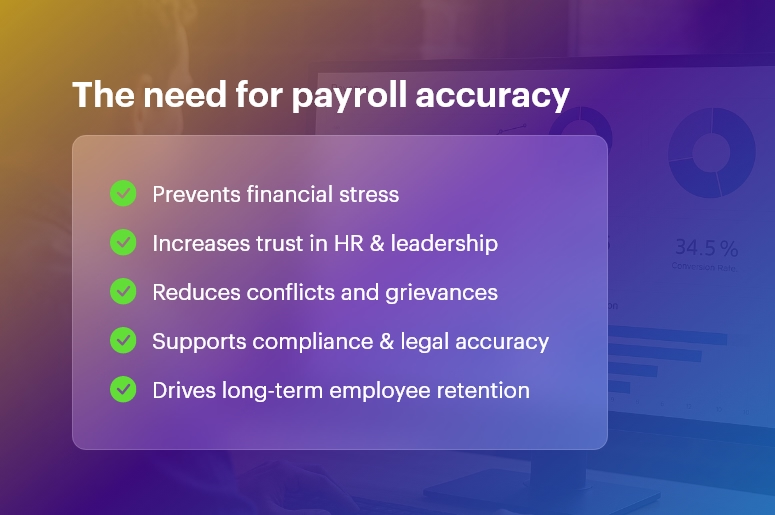

Payroll is more than a backend finance function. For employees, it is the most tangible expression of trust, fairness, and organizational reliability. When payroll is accurate, timely, and transparent, employees feel valued. When errors occur — even minor ones — they create frustration, distrust, and attrition risks.

In today’s competitive talent environment, accurate payroll directly impacts employee satisfaction and long-term retention. This makes it a strategic pillar for HR and business leaders who want to build a loyal, motivated, and high-performing workforce.

This guide explores why payroll accuracy matters, how it influences employee experience, and what organizations can do to strengthen payroll precision.

Why Payroll Accuracy Matters More Than Ever

Organizations today deal with complex workforce structures — remote teams, gig workers, freelancers, contractors, variable pay cycles, flexible shifts, and compliance-heavy regulations.

Against this backdrop:

- A single miscalculated payslip can trigger employee dissatisfaction.

- Delayed pay cycles erode trust in leadership.

- Incorrect statutory deductions can expose companies to compliance risks.

- Lack of payroll transparency fuels HR grievances.

Accurate payroll ensures reliability, which is foundational to employee confidence and employer reputation.

1. Accurate Payroll Strengthens Employee Trust

Accurate payroll is one of the strongest trust-building mechanisms within any organization.

Employees may forgive operational delays, minor communication issues, or workflow bottlenecks—but they rarely forgive payroll mistakes. Salary is deeply personal, and when it arrives on time and without errors, employees feel genuinely respected by the organization.

Consistently accurate payroll reflects the company’s seriousness toward its commitments.

When employees notice that their employer proactively ensures correct payments, they develop a perception of reliability and ethical leadership. This perception matters immensely for long-term retention.

Moreover, trust built through accurate payroll reduces internal escalations and friction across departments. HR and finance teams spend less time resolving disputes and more time building meaningful employee programs.

As trust grows, employees become more open to feedback, exhibit higher loyalty, and contribute more positively to the workplace culture.

2. Payroll Accuracy Reduces Employee Stress and Enhances Well-Being

Financial security is a foundational element of employee well-being. Even a minor discrepancy — such as a missing allowance, incorrect overtime calculation, or wrong tax deduction — can cause emotional stress.

Employees may panic, overthink, or become anxious about recurring mistakes, especially if they have financial commitments like EMIs, family expenses, or savings goals.

Accurate payroll eliminates these stress triggers. It gives employees peace of mind, knowing they can rely on their salary for their monthly responsibilities.

This sense of stability directly impacts mental well-being and overall life satisfaction.

Additionally, when payroll is error-free, employees do not need to chase HR for corrections, resubmissions, or clarifications.

This reduces frustration and allows them to maintain a balanced work-life experience. Over time, a consistently stable payroll environment enhances workforce morale and strengthens organizational loyalty.

3. Accurate Payroll Improves Productivity and Engagement

Productivity is often influenced by factors beyond skills or job roles. When employees are distracted by payroll issues — such as rectifying mistakes, seeking clarifications, or worrying about delayed payments — they lose valuable time and mental energy.

These disruptions compound over weeks and months, resulting in lower performance and disengagement.

Accurate payroll ensures employees can channel their complete focus toward deliverables and organizational goals. Without financial uncertainty, they feel motivated and more aligned with the company’s mission.

This leads to heightened engagement, reduced absenteeism, and improved team collaboration.

For HR and finance teams, accurate payroll significantly reduces operational cycles.

They are freed from repetitive error resolution tasks and can instead focus on strategic initiatives such as workforce planning, employee development, performance management, and culture-building activities. This creates a win-win situation for both employees and the organization.

India’s #1 Free Software

Free Payroll, PF, ESI & TDS Software

4. Payroll Accuracy Enhances Transparency and Reduces Conflicts

Transparency is a major driver of employee satisfaction. When employees clearly understand how their salary is calculated — earnings, deductions, taxes, reimbursements, overtime — they feel empowered and informed.

Inaccurate payroll, however, results in internal complaints, confusion, and disputes.

Accurate payroll supported by clear breakdowns and employee self-service access eliminates room for ambiguity. Employees can verify every component of their payslip, ensuring alignment between policy and payout.

This transparency removes guesswork and reduces friction between employees and HR teams.

Furthermore, accurate payroll prevents systemic issues from escalating across teams. Instead of dealing with recurring complaints or mistrust, HR leaders can maintain harmonious communication channels.

Conflict resolution becomes smoother, and teams feel confident approaching HR for support, not for disputes. When employees feel they are treated fairly, workplace relationships significantly improve.

5. Accurate Payroll Boosts Employer Brand & Retention Rates

Employee experience is now a critical component of employer branding. Companies known for payroll accuracy earn a positive reputation internally and externally.

Employees share their experiences with peers, on social media, and on employer review platforms.

A reputation for accurate payroll signals operational excellence, fairness, and employee-centric culture.

Candidates are more willing to join, and existing employees are less likely to leave because they feel financially secure and respected. This reduces voluntary turnover and hiring costs.

Additionally, payroll accuracy influences the employee’s perception of broader organizational systems.

If payroll is error-free, employees assume other processes — HR operations, performance management, and compliance — are also robust. This holistic positive experience plays a central role in employee retention.

6. Payroll Accuracy Supports Statutory Compliance and Reduces Legal Risk

Statutory compliance is a high-stakes area. Incorrect PF, ESI, TDS, gratuity, or bonus calculations can create liabilities for both employees and the organization.

Employees rely on payroll teams to ensure their contributions, tax deductions, and statutory benefits are accurately maintained.

Accurate payroll guarantees compliance with evolving labor laws and statutory regulations. It protects employees from tax penalties, incorrect filings, or financial discrepancies that may affect their long-term benefits.

For employers, accurate compliance management prevents legal consequences, audits, and monetary penalties.

Employees highly value an employer who safeguards their financial and legal interests. When payroll calculations and compliance filings are consistently correct, employees feel secure — and that security is a significant retention driver.

7. Accurate Payroll Helps Build a Culture of Fairness

A perception of fairness is central to employee morale. Payroll is the most visible indicator of fairness within an organization because it directly impacts employees’ lives and reflects how the company values their work.

When payroll is accurate, employees feel fairly compensated for their time, skills, and contributions. Transparent policies ensure that overtime, incentives, shift differentials, and bonuses are correctly calculated and paid.

Fairness strengthens mutual respect and reduces the likelihood of employees feeling left out, underappreciated, or discriminated against.

A workplace that consistently demonstrates fairness through accurate payroll naturally experiences higher engagement and lower attrition. Employees are more motivated to stay in a culture where their compensation is clear, just, and timely.

8. Accurate Payroll Facilitates Better Management Decisions

Payroll data is one of the richest sources of workforce insights. With precise payroll records, HR and management teams can make informed decisions about workforce planning, budgeting, cost optimization, performance-linked incentives, and resource allocation.

Accurate payroll also supports forecasting and compensation analysis. Leadership teams can evaluate pay structures, identify inconsistencies, and optimize salary benchmarks. This ensures that the organization remains competitive and equitable.

These data-driven decisions ultimately benefit employees as well. With better insights, companies can design more effective reward programs, improve appraisal cycles, and maintain fair compensation structures — contributing directly to employee satisfaction.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

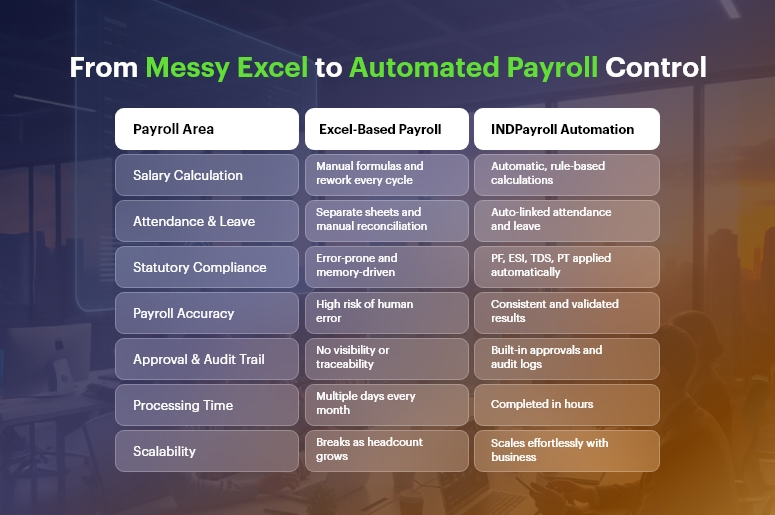

Key Causes of Payroll Inaccuracy (And How to Fix Them)

Common payroll errors

- Manual data entry mistakes

- Outdated spreadsheets

- Incorrect time and attendance data

- Policy misinterpretation

- Poor integration between HR, attendance, and finance systems

- Miscalculations of taxes, benefits, and statutory deductions

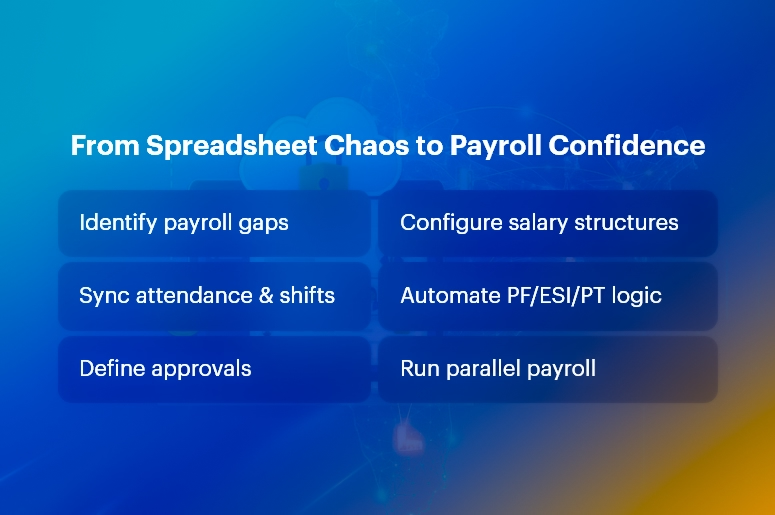

How to eliminate payroll errors

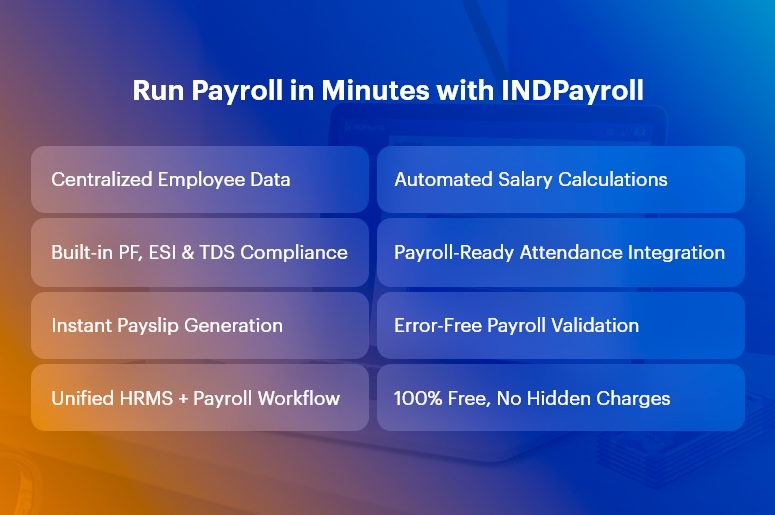

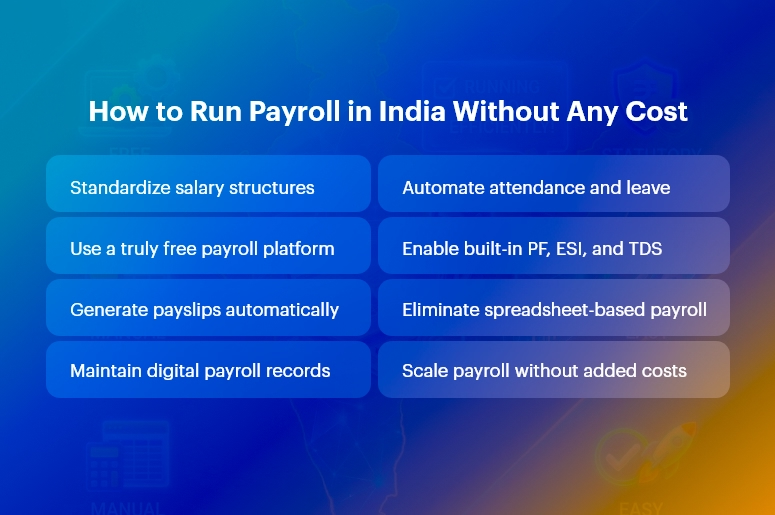

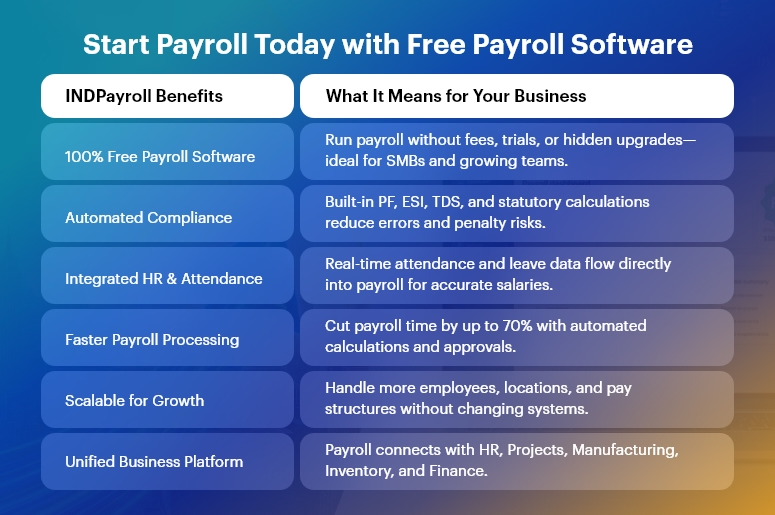

- Use modern, automated payroll software

- Integrate attendance, leave, and shift systems

- Maintain updated statutory rules

- Automate calculations and approvals

- Adopt employee self-service for transparency

- Conduct payroll audits regularly

Automation is the biggest enabler of error-free payroll.

How Technology Enables Accurate Payroll

Modern AI-powered payroll systems provide:

- Real-time data validation

- Automated statutory updates

- Intelligent error detection

- End-to-end calculation accuracy

- Seamless integration with HRMS, attendance, shift rosters, and finance systems

- Self-service payslips and tax statements

Organizations that invest in payroll automation see dramatic improvements in both satisfaction and retention.

India’s #1 Free Software

Free Payroll, PF, ESI & TDS Software

Conclusion

Accurate payroll is no longer a back-office function; it is a core component of the employee experience. When employees are paid correctly and on time, trust increases. When trust increases, engagement and retention naturally rise.

Organizations that adopt automated, compliant, and transparent payroll systems create happier teams and stronger employer brands.

Payroll accuracy is not just a financial priority; it is a people strategy — and a powerful one.

FAQs

1. Why is accurate payroll important for employee satisfaction?

Accurate payroll is essential because salary is the most fundamental expectation employees have from their employer. When payroll is correct, timely, and transparent, employees feel valued and respected. It strengthens trust in the workplace and eliminates stress caused by salary discrepancies.

Key reasons include:

- Ensures financial stability for employees

- Reduces stress and confusion

- Reinforces trust in HR and leadership

- Prevents conflicts and grievances related to pay

2. How does payroll accuracy influence employee retention?

Payroll accuracy is directly tied to retention because employees are less likely to leave an organization they perceive as fair, dependable, and respectful of their time and effort. When payroll is error-free, employees feel secure and are more inclined to stay long-term.

Retention benefits include:

- Higher loyalty and commitment

- Reduced attrition due to payroll frustration

- Positive employer brand perception

- Increased likelihood of employee referrals

3. What are the common reasons payroll mistakes happen?

Payroll errors usually stem from manual processes, miscommunication, or outdated systems. These mistakes often accumulate during monthly payroll runs and negatively impact both employees and HR teams.

Common causes include:

- Manual data entry

- Incorrect attendance and leave inputs

- Mismatched shift or overtime logs

- Outdated statutory rules

- Spreadsheet-based calculations

- Lack of integration between HRMS, attendance, and finance systems

4. How can payroll errors negatively impact employee morale?

Payroll errors create immediate frustration because they strike at an employee’s financial and emotional well-being. A single incorrect payslip can lead to dissatisfaction and disengagement.

Impact on morale includes:

- Loss of trust in the employer

- Increased stress and anxiety

- Perception of being undervalued

- Reduced enthusiasm and productivity

- Complaints and strained HR–employee relationships

5. Can accurate payroll improve organizational productivity?

Yes. Accurate payroll enhances productivity across the organization — not just for employees but also for HR and finance departments. When payroll runs smoothly, at scale, without disputes, everyone works more efficiently.

Benefits to productivity:

- Employees focus on work instead of salary issues

- HR teams avoid repetitive corrections and disputes

- Finance teams get accurate financial data

- Overall workflow becomes smoother and faster

6. How does accurate payroll support statutory compliance?

Accurate payroll ensures that all statutory deductions and filings — such as PF, ESI, TDS, LWF, gratuity, and bonuses — are calculated and submitted correctly. This protects both the company and employees from legal risks.

Compliance benefits include:

- Avoids penalties and violations

- Ensures correct employee contributions

- Builds trust by safeguarding employee benefits

- Makes audits and reporting easier

7. How does technology help improve payroll accuracy?

Modern payroll software automates calculations, updates statutory rules, validates data, and integrates with attendance, leave, and shift systems to ensure accuracy. By removing human error, technology delivers consistent and reliable payroll results.

Technology enables:

- Automated error detection

- Integrated data across HRMS and finance systems

- Real-time statutory updates

- Accurate overtime, bonus, and incentive calculations

- Transparent digital payslips and tax statements

8. What role does payroll transparency play in employee satisfaction?

Transparency builds clarity and eliminates confusion. When employees understand how their salary is computed—including earnings, deductions, taxes, and benefits—they feel more informed and empowered.

Benefits of payroll transparency:

- Reduces disputes and misunderstandings

- Improves trust in HR operations

- Demonstrates fairness in compensation

- Helps employees plan better financially

9. What steps can companies take to ensure payroll accuracy?

Companies must adopt a combination of automation, strong policies, and continuous audits to deliver accurate payroll consistently.

Key steps include:

- Implementing automated payroll software

- Integrating attendance, leave, and shift management systems

- Conducting periodic payroll audits

- Providing employees with self-service access to payslips and tax data

- Keeping statutory rules updated

- Training HR teams on payroll processes and compliance

10. How does accurate payroll contribute to a strong employer brand?

Employees judge organizations not just on culture or perks, but on reliability. Payroll accuracy sends a powerful message that the company respects its workforce. This influences how employees speak about the company internally and externally.

- Strong reputation as a fair and reliable employer

- Higher employee advocacy and referrals

- Lower public complaints that damage brand value

- Better ability to attract high-quality talent

India’s #1 Free Software

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.