If you want to grow faster, scale smarter, and reduce errors across your organization, then understanding how payroll integrations improve business productivity is essential.

In this comprehensive guide, we explain everything from what payroll integrations are to how they deliver tangible results for businesses of all sizes.

Moreover, we provide actionable tips, transition-rich insights, and best practices so you don’t need to look elsewhere.

What Are Payroll Integrations?

At the core, this integrations connect your payroll system with other business software such as human resources (HR), time tracking, accounting, and benefits management.

When payroll systems exchange data automatically, you say goodbye to manual entry, reconciliation errors, and wasted time.

In fact, one of the most compelling reasons businesses adopt integrations is to boost efficiency.

Most business leaders ask, “How exactly do integrations improve business productivity?” The answer lies in automation, accuracy, and seamless workflows.

Why Payroll Integrations Matter

For years, companies relied on manual processes. Yet manual work consumes hours, introduces errors, and frustrates employees. Fortunately, the integrations solve these challenges by enabling automatic data flow between systems.

To explain clearly:

- Time and Attendance Systems connect to payroll so that hours worked flow instantly into pay calculations. Therefore, teams don’t re-enter timesheets.

- HR Platforms sync employee data so that changes in status, pay grade, or benefits automatically update in payroll.

- Accounting Software receives payroll data for financial reporting without manual export or import.

When you integrate systems this way, payroll integrations improve business productivity by eliminating redundant tasks and accelerating workflows.

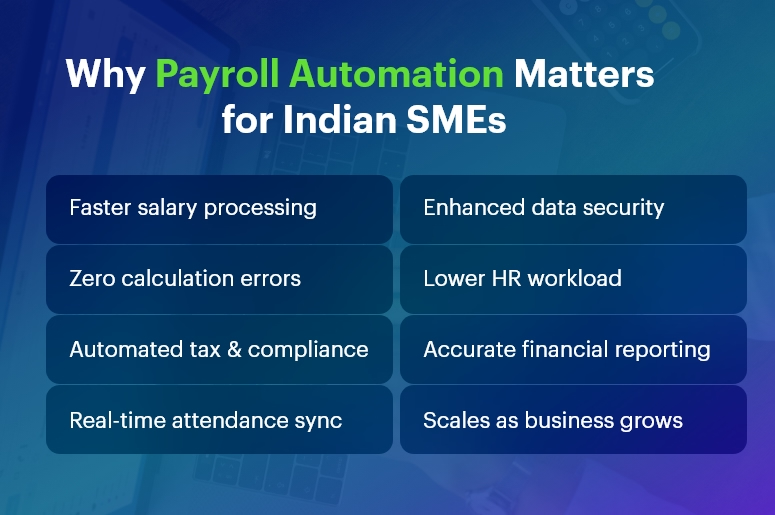

Top Benefits of Payroll Integrations

Now that we understand what this integrations are, let’s explore the real value they provide.

1. Eliminate Manual Data Entry

One of the most obvious ways payroll integrations improve business productivity is by removing manual data transfer. Instead of copying hours, pay rates, and deductions across systems, integrations handle it automatically.

Thus, HR and payroll staff save countless hours every pay cycle.

2. Reduce Errors and Compliance Risks

Human error is costly. Even a misplaced digit can result in underpaying an employee or triggering compliance violations.

Consequently, businesses that leverage payroll integrations see fewer mistakes. Because the systems speak directly to each other, accuracy increases and compliance risk decreases. Therefore, these integrations improve business productivity by protecting your organization and preserving employee trust.

3. Speed Up Payroll Processing

Time saved on manual tasks translates directly into speed. When systems exchange data without friction, payroll can process more quickly and with confidence.

Accordingly, your finance team can close books faster, and your HR team can focus on strategic initiatives rather than data cleanup. This is yet another way payroll integrations improve business productivity.

4. Improve Visibility and Reporting

With integrated systems, data isn’t trapped in silos. Instead, leaders access real-time insights across payroll, HR, and finance.

Therefore, you can generate meaningful reports instantly without waiting for manual consolidation. As a result, payroll integrations improve business productivity by enabling smarter decision-making.

5. Enhance Employee Experience

Employees expect fast and accurate pay. When payroll integrates with leave management, time tracking, and benefits systems, employees benefit from a smooth experience with fewer pay issues.

Naturally, this increases engagement and reduces HR support inquiries — further evidence that the integrations improve business productivity.

Free Payroll, PF, ESI & TDS Software

Related Systems That Benefit from Payroll Integrations

“Payroll doesn’t operate in isolation,” you might think. That’s correct. A modern technology ecosystem requires integrations across multiple platforms.

Below are the key systems that tie into payroll and amplify productivity:

HR Information Systems (HRIS)

An HRIS houses employee records, job roles, benefits, and performance data. When payroll syncs seamlessly with HRIS:

- New hire data flows instantly

- Pay rate changes update automatically

- Terminations close out correctly

Thus, integrations improve business productivity by avoiding duplicated updates.

Time & Attendance Platforms

These tools track worked hours, overtime, and leave. When they integrate with payroll:

- Time records flow automatically into pay runs

- PTO balances update accurately

- Compliance with labor laws improves

Clearly, this connection drives productivity by reducing reconciliation work and ensuring accuracy.

Benefits Administration Systems

Benefits information such as insurance, retirement contributions, and deductions must feed into payroll accurately.

Because benefits systems integrate with payroll, changes in coverage update without manual entry — another proof point of how payroll integrations improve business productivity.

Accounting and Financial Software

Payroll generates expenses, taxes, and liabilities that must appear in accounting. Integrations ensure that payroll data appears where it should in your financial records.

Consequently, integrations improve business productivity by eliminating dual entry and accelerating month-end close.

How Payroll Integrations Improve Business Productivity: Real-Life Examples

To make this more concrete, here are practical examples of how businesses benefit.

Example 1: Faster Onboarding

Before integration, HR staff manually entered every new employee into payroll. Now, onboarding in the HR system automatically creates a payroll record. Therefore, staff save hours weekly and avoid errors.

This direct automation is how integrations improve business productivity—fewer touches, less time, superior accuracy.

Example 2: Automated Time Tracking to Payroll

A manufacturing company integrated its time clocks with payroll. Consequently, they eliminated hundreds of hours of weekly data entry. Errors dropped significantly, compliance improved, and payroll closed rapidly each pay period.

This concrete outcome once again shows how payroll integrations improve business productivity.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

Implementation Guide: How to Integrate Payroll Successfully

So far, you know the benefits and systems involved. Next, here’s how to implement integrations effectively.

1. Define Objectives Clearly

Start by defining what you want to achieve. For example:

- Do you want to eliminate manual entry?

- Do you need more accurate reporting?

- Do you want automatic benefits reconciliation?

When you articulate these goals, you understand how payroll integrations improve business productivity for your organization.

2. Select Compatible Software

Not all systems integrate easily. Therefore, choose payroll, HR, and related software that support open APIs or pre-built connectors. If you select compatible systems from the start, integration will be smoother and more effective.

This decision directly impacts how integrations improve business productivity.

3. Map Your Data Flows

Next, document what fields need to flow between systems — for example, employee IDs, hours worked, benefits codes, tax details, and pay rates.

When you map these flows upfront, you reduce confusion and minimize implementation delays. This preparation reinforces how payroll integrations improve business productivity.

4. Plan for Testing

Before going live, test thoroughly. Confirm that data moves correctly, calculations remain intact, and exceptions trigger alerts. Without testing, you risk broken processes, which defeats the purpose of integrations.

Thorough testing is crucial to show how integrations improve business productivity in practice.

5. Train Users

Even the best systems fail without user adoption. Train HR, payroll, and finance teams to understand the integration and how it changes their process.

Proper training ensures teams embrace changes and realize how payroll integrations improve business productivity.

Common Challenges and How to Overcome Them

Despite the clear benefits, some businesses encounter obstacles.

Data Quality Issues

If source data is inconsistent, integrations yield poor results. To mitigate this:

- Clean existing data

- Standardize formats

- Use validation rules

This improves accuracy and reinforces how integrations improve business productivity.

Integration Costs

Initial costs can concern some organizations. However, you must consider the long-term ROI. Automation saves time and reduces errors. When you calculate total savings, you see how payroll integrations improve business productivity outweighs upfront investment.

Change Management

Integrations can disrupt workflows. Therefore, communicate early, involve stakeholders, and support employees in the transition. With the right approach, teams will adopt new processes and appreciate how integrations improve business productivity.

Best Practices for Payroll Integration Success

To derive maximum benefit, adopt these best practices:

Use Standardized Data Formats

Standardization prevents mismatches and improves consistency. This step ensures your integration functions as expected and reinforces how payroll integrations improve business productivity.

Monitor Integrations Continually

Set up automated monitoring and alerts so that if a data sync fails, your team knows immediately. This proactive stance preserves productivity — a key way integrations improve business productivity.

Document Everything

Documentation ensures clarity. When team members understand integration logic and dependencies, they can troubleshoot issues fast. This clarity supports how payroll integrations improve business productivity in daily operations.

Future Trends: Payroll Integrations and AI

Emerging technologies like artificial intelligence and machine learning are reshaping payroll. For instance:

- AI can predict anomalies before payroll runs

- Intelligent bots can recommend corrections

- Systems can learn patterns and suggest process improvements

These innovations will amplify how integrations improve business productivity even further in the years ahead.

Conclusion

Now you understand the complete landscape of how payroll integrations improve business productivity. You have seen:

- What integrations are

- Why they matter

- The systems that benefit

- Real examples

- Implementation steps

- Challenges and best practices

- Future trends

By adopting integrations, you eliminate manual work, reduce errors, accelerate processes, and empower your teams.

Consequently, integrations improve business productivity in every part of your organization.

If you implement these strategies thoughtfully, you’ll increase efficiency, elevate compliance, and strengthen employee satisfaction — all without needing to consult another guide.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.

Frequently Asked Questions (FAQ)

1. What are payroll integrations?

Payroll integrations connect payroll software with HR, time tracking, accounting, and benefits systems so data flows automatically without manual entry.

2. How do payroll integrations improve business productivity?

integrations improve business productivity by eliminating repetitive data entry, reducing errors, speeding up payroll cycles, and enabling teams to focus on strategic work instead of administrative tasks.

3. Which systems are most commonly integrated with payroll?

Payroll is most commonly integrated with HRIS, time and attendance systems, accounting software, and benefits administration platforms.

4. Can payroll integrations reduce payroll errors?

Yes. By automating data flow between systems, integrations significantly reduce manual mistakes that lead to incorrect pay, compliance issues, and employee dissatisfaction.

5. Are payroll integrations suitable for small businesses?

Absolutely. Small businesses benefit greatly from integrations because automation reduces workload, improves accuracy, and supports scalable growth without adding headcount.

6. How long does it take to implement payroll integrations?

Implementation timelines vary. Simple integrations can take a few weeks, while complex multi-system integrations may take several months depending on data complexity and testing requirements.

7. Do payroll integrations help with compliance?

Yes. integrations improve compliance by ensuring accurate time data, correct tax calculations, and consistent employee records across systems.

8. What are the common challenges with payroll integrations?

Common challenges include poor data quality, system incompatibility, upfront integration costs, and user resistance. Proper planning and training help overcome these issues.

9. Are payroll integrations secure?

Reputable integrations use encryption, secure APIs, access controls, and compliance standards to protect sensitive payroll and employee data.

10. What is the ROI of payroll integrations?

The ROI comes from time savings, reduced errors, faster payroll processing, improved compliance, and higher employee satisfaction—all of which contribute to improved business productivity.