A single broken Excel formula can quietly destroy a payroll cycle.

Not dramatically.

Not instantly.

But slowly — through incorrect deductions, delayed salaries, compliance notices, and frustrated employees.

Yet even in 2025, many growing businesses still run payroll on spreadsheets held together by habit, workarounds, and tribal knowledge. What begins as a “temporary Excel solution” often becomes a permanent operational risk.

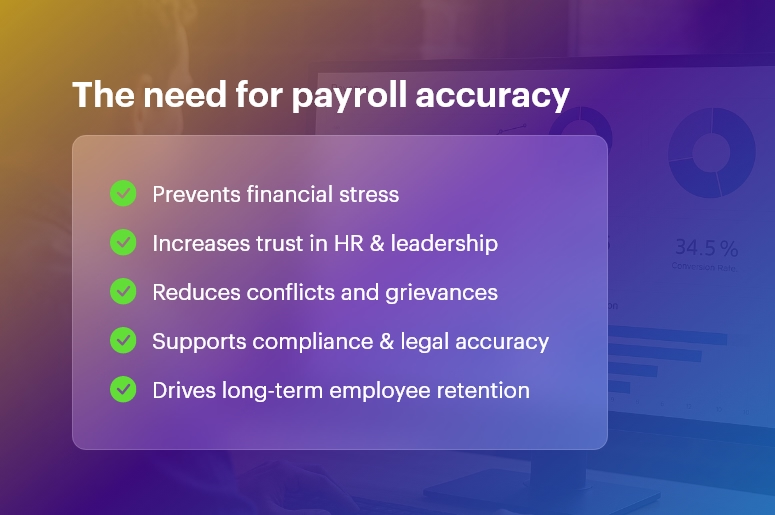

Payroll today is no longer a back-office task. For small and mid-sized businesses, it sits at the crossroads of compliance, finance, HR, and employee trust. Attendance data, variable pay, statutory deductions, approvals, and reporting all need to work together — accurately and on time.

Excel was never designed for this level of complexity.

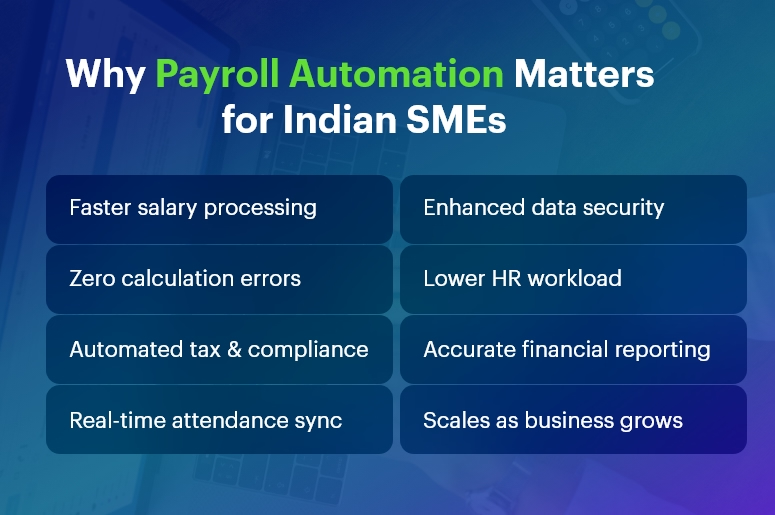

This is why payroll automation for small and mid-sized businesses is no longer a nice-to-have. It is the difference between controlled operations and constant firefighting.

In this guide, we will break down why Excel-based payroll fails modern businesses, the risks leaders often underestimate, and how INDPayroll turns messy payroll data into a clean, compliant, and scalable system — without disruption.

Why Excel Payroll Breaks as Businesses Grow

Spreadsheets fail quietly. That’s what makes them dangerous.

They rely on:

- Manual inputs and fragile formulas

- Disconnected attendance and leave data

- Individual ownership instead of system logic

- Limited auditability and change tracking

As payroll complexity increases, Excel does not scale — it fractures.

In manufacturing, shift-based attendance, overtime rules, and multi-location compliance push spreadsheets past their limits. In retail and distribution, high employee churn and variable pay structures expose gaps every month.

Professional services and logistics firms struggle with reimbursements, incentives, and project-based compensation.

As headcount grows, payroll complexity grows faster.

Compliance rules evolve. Leadership expects real-time visibility. Finance demands accuracy. HR needs consistency. At this stage, Excel stops being a cost-saving tool and becomes a business liability.

This is precisely where payroll automation for small and mid-sized businesses becomes essential.

What Payroll Automation Actually Fixes

Payroll automation is not about replacing people.

It is about replacing uncertainty with systems.

Automated payroll:

- Removes manual calculations

- Enforces statutory rules consistently

- Reduces dependency on individual employees

- Creates a single source of truth across teams

INDPayroll is built specifically to address this reality. It takes unstructured Excel payroll data and converts it into a structured, rule-driven, automated payroll engine — designed to grow with the business.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.

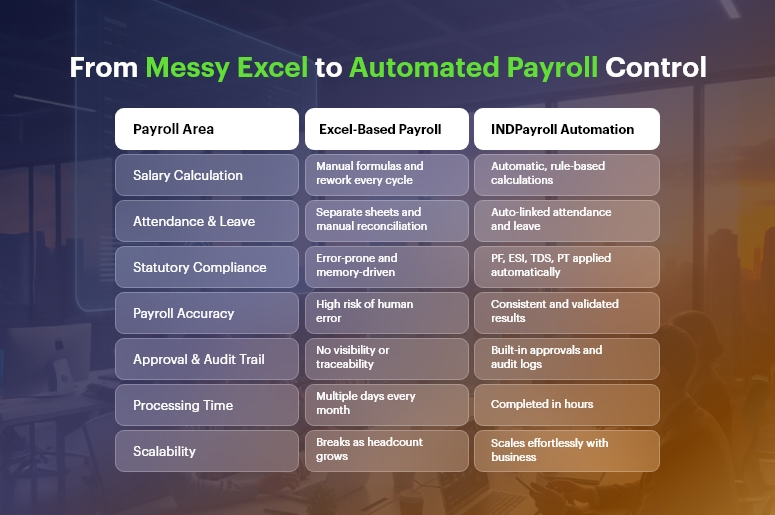

A Practical Framework for Moving from Excel to Automation

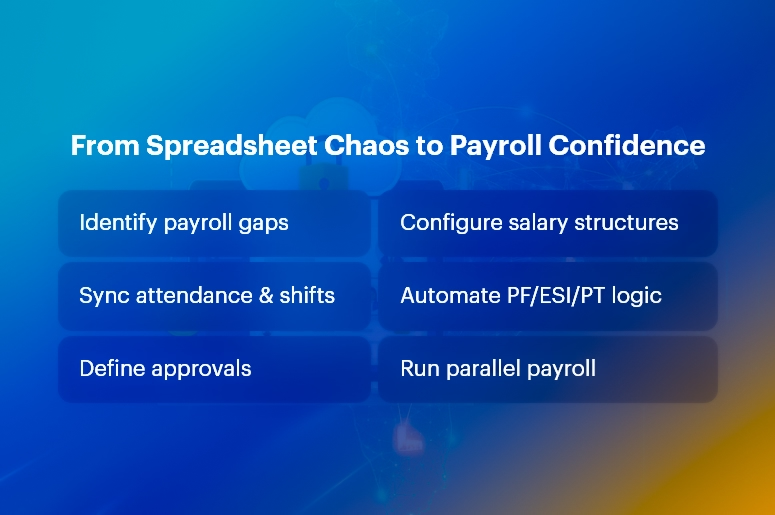

Step 1: Standardize Before You Automate

Automation magnifies structure — or chaos.

Before switching, businesses must standardize salary components, deductions, and attendance inputs. Pay rules for overtime, incentives, reimbursements, and statutory deductions must be clearly defined.

INDPayroll simplifies this step by importing Excel data and mapping it directly into structured payroll fields, removing inconsistencies at the source.

Step 2: Connect Attendance, Leave, and Payroll

Disconnected systems create duplicate work and human error.

Attendance should feed payroll automatically. Leave policies should adjust salaries based on predefined rules. Manual reconciliation should disappear.

INDPayroll unifies attendance, HRMS, and payroll into a single workflow — so data flows without friction.

Step 3: Make Compliance the Default

Compliance errors are expensive, repetitive, and avoidable.

Statutory rules like PF, ESI, TDS, and PT must be system-driven, not memory-driven. Automation ensures rules are applied consistently and updated centrally.

INDPayroll embeds compliance logic into every payroll run, reducing penalties and rework.

Step 4: Build Transparency Into Payroll

Payroll should never be a black box.

Approval workflows prevent unauthorized changes. Audit trails create accountability. Every adjustment should be traceable.

INDPayroll ensures payroll runs are review-ready, approval-driven, and fully auditable.

Step 5: Enable Cross-Functional Visibility

Payroll data is operational data.

HR needs employee-level clarity.

Finance needs cost and liability visibility.

Leadership needs summaries and trends.

INDPayroll connects payroll with HR, finance, projects, manufacturing, inventory, and CRM — turning payroll into an intelligence layer, not just a process.

Do’s and Don’ts of Payroll Automation

Do:

- Automate repetitive payroll calculations

- Centralize employee and salary data

- Review payroll reports before finalization

Don’t:

- Depend on individual-owned Excel files

- Ignore statutory updates

- Wait for penalties before automating

Common Mistakes Businesses Make

- Migrating Excel data without validation

- Over-customizing payroll logic too early

- Ignoring change management for HR teams

Automation works best when it is deliberate, not rushed.

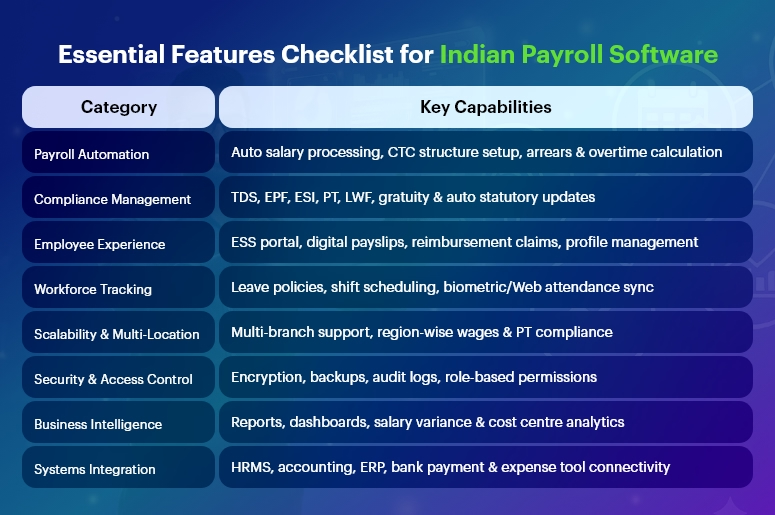

Why INDPayroll Works Where Others Stop

INDPayroll is not just payroll software.

It is an integrated operational platform connecting HRMS, Payroll, Manufacturing, Projects, Inventory, CRM, and Finance. Payroll automation becomes part of the business ecosystem — not an isolated function.

That is what makes payroll automation for small and mid-sized businesses sustainable, scalable, and future-ready with INDPayroll.

A Real-World Example

Shakti Components, a mid-sized manufacturing company, ran payroll on Excel with shift-based attendance and overtime calculations. Payroll processing took four days every month. Errors were frequent. Compliance corrections were routine.

After implementing INDPayroll, attendance, HR records, and statutory rules were integrated into one automated system.

Within two payroll cycles:

- Payroll time reduced by 65%

- Accuracy improved to 99.8%

- Compliance rework dropped to zero

- HR and finance saved 20+ hours per month

More importantly, leadership gained confidence in payroll data. Payroll stopped being a bottleneck and became a reliable operational asset.

Free Payroll, PF, ESI & TDS Software

Key Takeaways

Messy Excel payroll files are not just inconvenient. They are risky.

As businesses scale, payroll complexity outpaces manual systems. Automation is not about speed alone — it is about control, compliance, and confidence.

By adopting payroll automation for small and mid-sized businesses, organizations reduce errors, save time, and strengthen employee trust. The real value, however, comes from systems that connect payroll with HR, finance, and operations.

INDPayroll delivers exactly that: a connected, compliant, and scalable payroll ecosystem built for modern businesses.

The future of payroll is automated — and businesses that embrace it early gain a clear operational advantage.

FAQs

1. What is payroll automation for small and mid-sized businesses?

It uses software to automatically calculate salaries, deductions, compliance, and reports, reducing manual work and errors.

2. Can INDPayroll handle messy Excel payroll data?

Yes. INDPayroll is designed to import, clean, and structure messy Excel payroll files into automated workflows.

3. Is payroll automation expensive for small businesses?

No. INDPayroll offers 100% free payroll automation, making it accessible for growing businesses.

4. Does payroll automation ensure statutory compliance?

Yes. PF, ESI, TDS, and PT rules are applied automatically and updated regularly.

5. How long does migration from Excel take?

Most businesses complete the transition within one to two payroll cycles.

6. Can payroll automation integrate with HR and finance?

Yes. INDPayroll integrates payroll with HRMS, finance, projects, manufacturing, and inventory.

7. Is payroll automation secure?

INDPayroll uses role-based access, approvals, and audit logs to ensure data security and compliance.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.