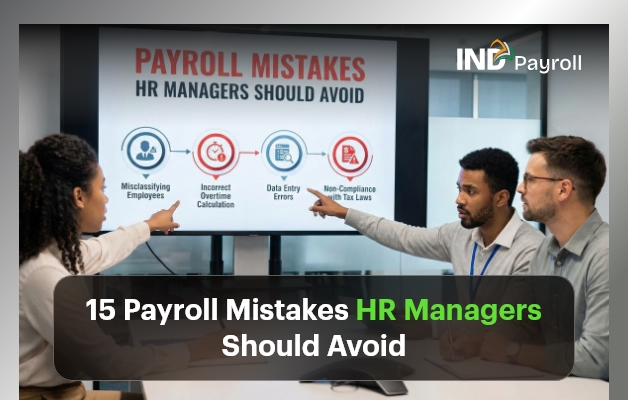

Payroll looks simple from the outside. However, in reality, payroll is one of the most complex and high-risk responsibilities HR managers handle. Even small payroll mistakes can snowball into legal penalties, employee dissatisfaction, compliance failures, and damaged trust.

Moreover, payroll errors don’t just affect numbers. They affect people. That’s why avoiding mistakes isn’t optional—it’s critical.

In this guide, you’ll learn the 15 most damaging payroll mistakes HR managers make, why they happen, how they impact organizations, and—most importantly—how to prevent them permanently.

Why Payroll Mistakes Are So Costly

Before we dive in, it’s important to understand why mistakes matter so much.

Payroll directly impacts:

- Employee morale and trust

- Legal and tax compliance

- Company reputation

- Financial forecasting

- Audit readiness

Therefore, when HR teams repeat payroll mistakes, they lose credibility internally and invite scrutiny externally. Fortunately, most payroll errors are predictable and preventable.

1. Employee Misclassification

Employee misclassification remains one of the most common mistakes. HR managers often misclassify workers as:

- Contractors instead of employees

- Exempt instead of non-exempt

- Part-time instead of full-time

As a result, companies underpay wages, skip overtime, or miscalculate benefits.

How to avoid this Payroll Mistake: Regularly review job roles, working hours, and labor laws. Additionally, document classification decisions clearly.

2. Inaccurate Time and Attendance Tracking

Another frequent Payroll Mistake is relying on manual or inconsistent time tracking. When employees log hours incorrectly, payroll calculations immediately suffer.

Consequently, HR teams face disputes, corrections, and reprocessing cycles.

Prevention tip: Use automated time tracking tools that integrate directly with payroll and flag inconsistencies early.

3. Ignoring Payroll Compliance Laws

Payroll laws change frequently. Unfortunately, many HR teams fail to track updates, creating serious mistakes related to:

- Minimum wage

- Overtime rules

- Statutory deductions

- Regional labor regulations

Therefore, staying informed isn’t optional.

Best practice: Assign compliance ownership and subscribe to regulatory updates.

4. Incorrect Tax Calculations

Tax errors are among the most expensive payroll mistakes. Even a small miscalculation can result in penalties, audits, and employee dissatisfaction.

Common issues include:

- Incorrect tax slabs

- Missed deductions

- Outdated tax rules

Solution: Automate tax calculations and validate them monthly.

5. Poor Payroll Record Management

Payroll documentation isn’t just for reference—it’s legally required. Missing or incomplete records lead to Payroll mistakes during audits or disputes.

This includes:

- Payslips

- Tax filings

- Attendance logs

- Adjustment records

Fix: Digitize payroll records and enforce retention policies.

6. Overlooking Overtime Compliance

Overtime errors are silent mistakes. Many HR managers either miscalculate overtime or forget eligibility rules.

As a result, employees feel cheated, and legal exposure increases.

Avoidance strategy: Configure payroll systems to auto-calculate overtime based on policy and law.

7. Inconsistent Pay Schedules

Inconsistent payroll cycles confuse employees and erode trust. This Payroll Mistake often happens due to:

- Manual processing delays

- Poor coordination

- Last-minute changes

Best approach: Lock payroll calendars and communicate schedules clearly.

8. Errors in Leave and Absence Calculations

Leave policies directly affect payroll. When HR teams miscalculate paid leave, unpaid leave, or accruals, they create recurring Payroll mistakes.

Solution: Integrate leave management with payroll to ensure accuracy.

9. Incorrect Benefit Deductions

Benefits mismanagement causes confusion and frustration. This Payroll Mistake occurs when:

- Wrong benefit plans apply

- Eligibility isn’t updated

- Deductions don’t match enrollments

Prevention: Sync benefits administration with payroll systems.

10. Mishandling Payroll Adjustments

Bonuses, incentives, reimbursements, and corrections often introduce mistakes. Manual entries increase error probability.

Better way: Standardize adjustment workflows and require approvals.

11. Poor Payroll Reconciliation

Without reconciliation, Payroll mistakes go unnoticed. HR managers must compare:

- Payroll vs. accounting records

- Tax withholdings vs. payments

- Headcount vs. payroll lists

Best practice: Reconcile payroll every cycle, not quarterly.

12. Lack of Payroll Audits

Skipping audits guarantees recurring mistakes. Audits reveal:

- System misconfigurations

- Policy mismatches

- Compliance gaps

Recommendation: Conduct internal payroll audits at least quarterly.

13. Weak Payroll Data Security

Payroll data includes sensitive employee information. Security lapses turn into catastrophic Payroll mistakes through breaches or leaks.

Security essentials:

- Role-based access

- Encrypted storage

- Audit trails

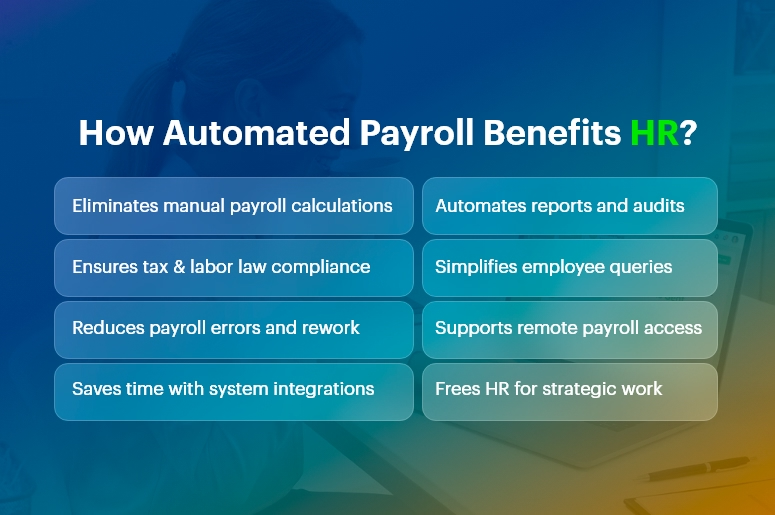

14. Overdependence on Manual Processes

Manual payroll processing multiplies mistakes. Every spreadsheet, email, and manual entry increases risk.

Smart move: Automate payroll wherever possible and eliminate redundant steps.

15. Inadequate Payroll Training

Even the best tools fail without trained users. Poor training causes repeated Payroll mistakes across cycles.

Fix: Train HR and payroll staff regularly and document processes clearly.

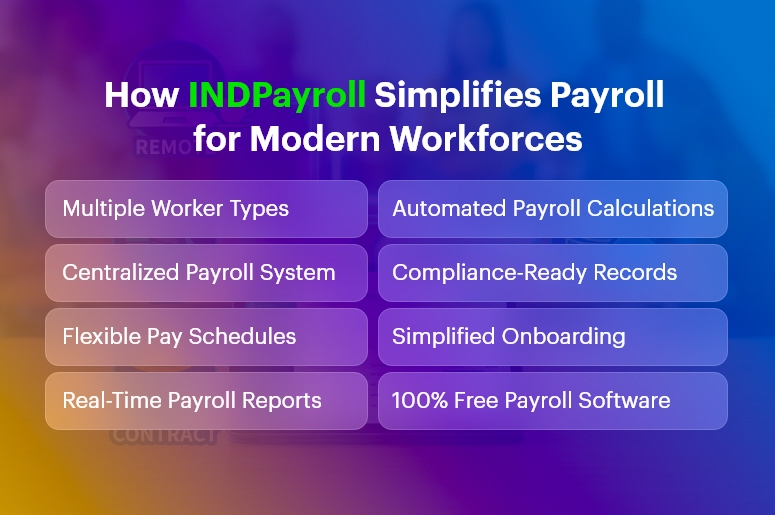

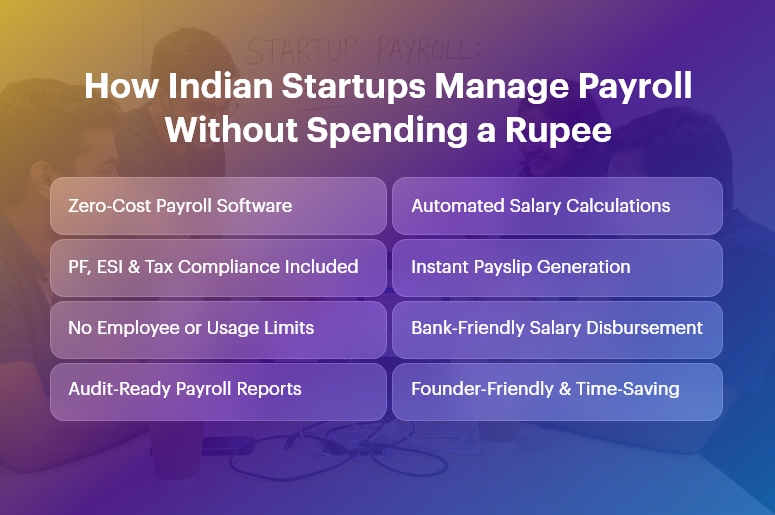

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

How Payroll Mistakes Impact Employees

mistakes don’t stay in HR—they hit employees directly. Effects include:

- Delayed salaries

- Incorrect payslips

- Tax issues

- Reduced trust

Eventually, employees lose confidence in HR and management.

How Payroll Mistakes Impact Businesses

From a business perspective, Payroll mistakes lead to:

- Compliance penalties

- Audit failures

- Productivity loss

- Brand damage

- Legal exposure

Therefore, payroll accuracy directly supports organizational stability.

Best Practices to Eliminate Payroll Mistakes

To minimize mistakes, HR managers should:

- Automate payroll and time tracking

- Integrate HR, attendance, and finance

- Stay updated on compliance

- Audit payroll regularly

- Train teams continuously

- Use secure, scalable payroll systems

Frequently Asked Questions

What are the most common Payroll mistakes?

Employee misclassification, tax errors, and time tracking issues.

How often should payroll be audited?

Monthly reviews and quarterly audits reduce mistakes significantly.

Can payroll software eliminate Payroll Mistakes?

It reduces errors, but proper setup and training remain essential.

Final Thoughts

Payroll mistakes are expensive, damaging, and avoidable. HR managers who proactively address mistakes protect employees, strengthen compliance, and build trust.

If you want payroll accuracy, don’t fix errors after the fact. Instead, design payroll systems that prevent mistakes from happening in the first place.